Understanding your income statement: the money you earn is not the money you keep

Have you ever heard the saying: “revenue is vanity, profit is sanity, cash is king”? Well, you have now! What the heck does it mean anyway, and why should you care? There’s a lot of jargon in the world of business. Honestly, you need a dictionary sometimes. Business finances are no different. There are a lot of terms being thrown around. We thought we’d clear the air by sharing the most important ones (in our opinion). You are off to a great start if you know these numbers and what they mean vis-à-vis your business!

Revenue:

Revenue is the money a company earns from the sale of its products and/or services. It includes all income from all sources before any deductions or expenses. It is essential to know your revenue, not just as an individual data point but in relation to the other numbers we cover in this blog. You may hear many entrepreneurs throw around impressive revenue numbers (Dragon’s Den, anyone?), but this number on its own does not give you a clear picture of the health of a business. Why? Revenue doesn't mean much without the perspective of expenses. If your expenses are higher than your revenue you could be losing money in your business. This is why revenue is sometimes referred to as a vanity metric. An over-focus on revenue, without giving proper attention to the costs associated with earning that revenue, can mean a lack of profitability. This brings us to our next point…

Profit:

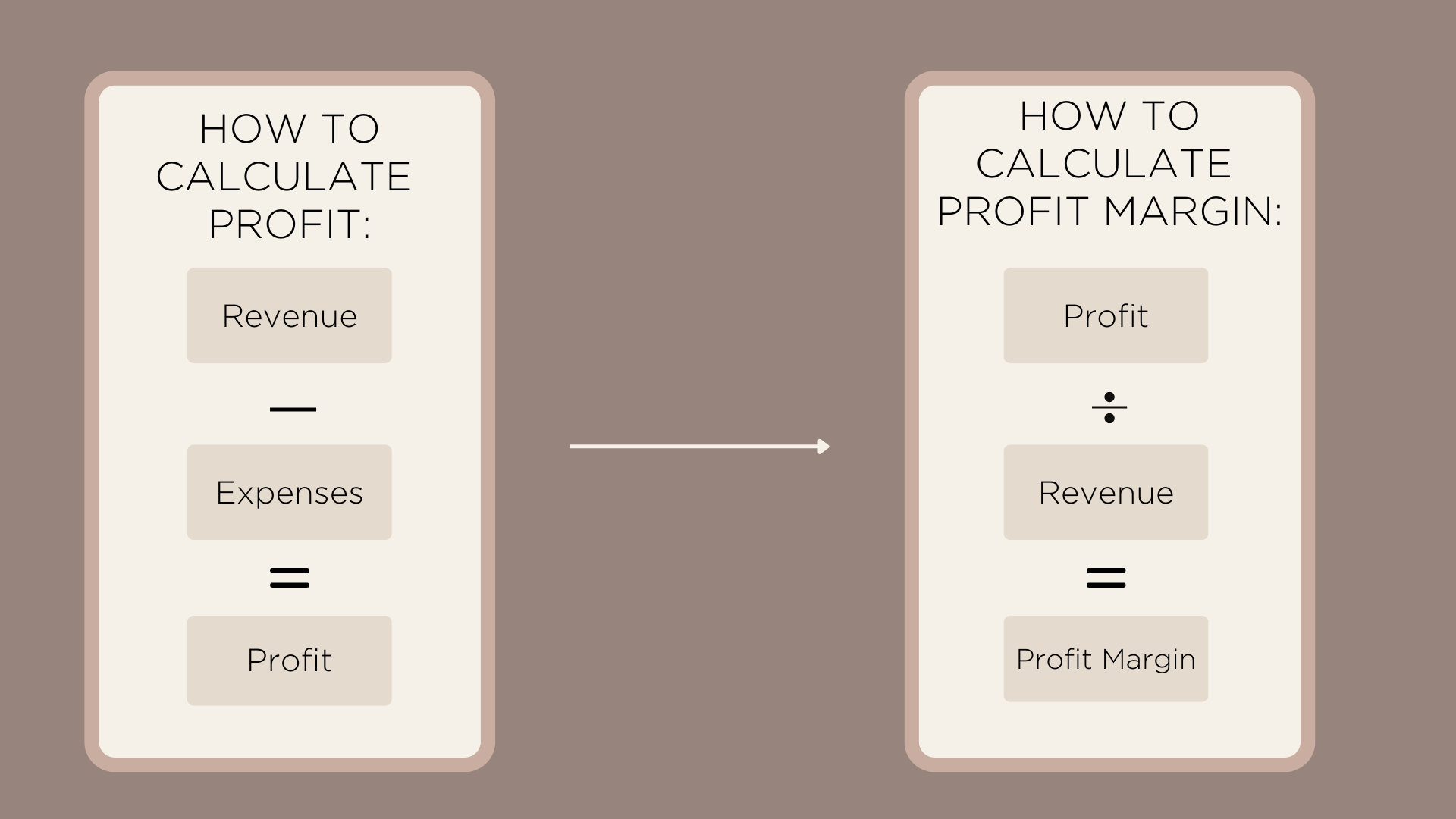

Profit, in a nutshell, is what you have left after you pay your expenses. For you math nerds out there:

Profit = Revenue - Expenses

We are not going to get all technical on you here. But we do want to make this one point: profit is the fundamental marker of business success - not revenue. If your expenses are high in relation to your revenue, your profit will always be low, or even negative (a.k.a. loss).

Expenses can include everything from costs you need to operate your business such as subcontractors, office supplies, rent and advertising. Once you take all that off your revenue, you can see how much your business makes. Your profit can be a great way to guide your pricing. If your profit is not as high as you would like it to be, you can consider raising prices or cutting costs. Consider doing both for even bigger profit results. By evaluating your offerings from this angle, you can make intelligent, strategic moves in your business. After all, your #1 goal should be to become profitable (i.e. have $ left in the bank).

Subscribe to our newsletter for more tips on growing your business.

Cash and Cash Flow:

Nothing beats good old cash in the bank. Here’s what you need to know about cash from a business perspective. Cash is the lifeblood of your business. Without it, you can’t pay your business costs or yourself for all your hard work.

Cash flow is the way money moves through your company. . A business in a positive cash flow position can pay all its expense obligations. The amount of cash left over in the business after all your expenses and financial obligations are paid is called free cash flow . It’s money that is free to be used for things like reinvesting back in the business, offsetting future slumps, or even paying bonuses. Negative cash flow occurs when a business does not generate enough revenue to cover its operating expenses and debt payments. Although this is common with new businesses, there should be a plan in place to get to a positive cash flow position and profitability as fast as possible.

Margins:

Have you ever calculated your profit margin? Get ready because you are about to. Knowing your margins is crucial. Imagine you were working your tail off on a business that, at the end of the day, wasn’t making you the money you wanted. Knowing your margins can help you gain insight into how to price and structure your business. Maybe you need to revisit your whole business model, or maybe your pricing strategy needs to shift. You will not know which badass business moves to make unless you know your margins.

Here’s how to figure it out. Take your revenue, subtract your expenses, and divide that by that initial revenue figure.

Here’s a simple example: You are a coach with annual revenue of $100,000. Your expenses are S40,000, leaving you with a profit of $60,000. So then we take $60,000 in profit divided by $100,000 in revenue.

In this case, your profit margin is 60%.

What your profit margin should be depends on your business. All industries have different targeted profit margins. Product based businesses often have lower profit margins than service based businesses. The real value in keeping track of your own profit margin is being able to compare it over time as your business evolves, grows and you try new things. How these changes impact your profit margin will tell you if it was a financial win or not.

The Bottom Line

Business owners often focus only on a part of the picture when it comes to their money…the revenue part. Revenue is just one piece of the puzzle that shows you the health of your business. We have a saying at Grow CPA: "know it to grow it", and it fits like a glove here. By knowing your numbers you are in a position of power. You are able to fine-tune all aspects of your business and have a clear picture of where you are headed and where you need to make adjustments.

Interested in learning more from us? Follow along with us through our social media accounts (find us on Instagram @growcpa) and sign up for our newsletter for more educational and fun financial content.

Wishing you success in your business,

- Martina + Ashli

Date published: June 7, 2022

Disclaimer - The information provided in this blog is general in nature and solely for educational purposes. Readers use and implementation of the information comes at their own risk and is their own responsibility.